AI in Insurance: Utility, Impact, Scope, and Beyond!

It is natural to think that some industries do not face the impact of technologies like artificial intelligence (AI). However, the digital revolution demands that professionals use AI in insurance, hospitality, agriculture, and other ‘uncommon’ sectors.

Globally, the insurance market values over approx. USD 6 trillion. So, specialists in this domain utilize all the available technologies to flourish in this booming market.

If you work in the finance sector, it is vital to understand the utility of AI in the insurance industry. Thorough knowledge of this facet can keep you up-to-date with the impact of AI, a trending and ever-growing technology.

In this blog, we delve into some of the practical use cases of AI in insurance. From automating tasks to detecting fraud, assessing risks, and customizing user experiences, we bring you real-world use cases of how AI is transforming the insurance industry.

What is AI in Insurance?

Artificial intelligence (AI) is an intriguing technology that enables a digital product to perform tasks with human-like proficiency.

You may be aware of products like Gemini or ChatGPT. These names are apt examples of generative AI.

Now, AI is quite a standard tool for developers, content creators, businesspersons, and marketing professionals. Still, its utility spans prominent industries like software development, digital marketing, and content.

AI in the insurance industry finds utility for the following purposes:

- Automating tasks

- Detecting frauds

- Assessing risks

- Customizing user experiences

So, ‘AI in insurance’ simply implies using artificial intelligence to enhance the services in the finance sector.

Interested in knowing the prominent AI types? Read our blog on generative vs predictive AI.

How AI in the Insurance Industry Works?

You must be thinking — the insurance industry demands skills in numeracy, customer service, finance, and communication. So, why should we become conversant with AI?

Well, the answer is simple.

AI becomes your auxiliary partner by bolstering facets like claims processing, underwriting, and customer service. Consider this knowledge as an investment for the future.

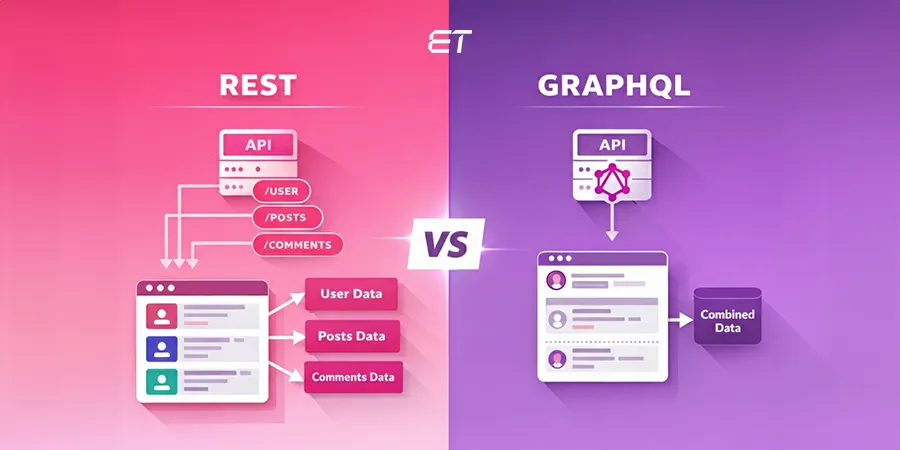

Artificial intelligence functions in various ways. Refer the following table to understand the main functionalities in brief.

| Function | Explanation |

| Machine Learning | Developers can train algorithms on historical data, allowing them to analyze new information. For instance, by analyzing past claims data, AI can predict the potential cost of a new claim |

| Automation | You can automate repetitive and monotonous tasks like filling out forms or reviewing basic information in claims |

| Data Analysis | Insurers can collect vast amounts of information like driving records to health history. AI algorithms scan through this vital data to identify relevant patterns |

| Risk Assessment | By analyzing a wider range of data points, AI can create a more nuanced picture of an individual’s risk profile. So, you can offer better personalized rates and coverage options |

| Virtual Assistance | AI can power chatbots and virtual assistants can answer customer questions, process simple requests, and even provide basic policy information |

Impact of AI on the Insurance Industry

If you’re in the finance sector, one thing is clear – AI has the potential to revolutionize the insurance industry. Understanding its positive impact can help you stay ahead of the curve and enhance your output in this dynamic sector.

1. High Efficiency

AI in insurance can boost your efficiency through the following outcomes:

- Streamlined workflows

- Improved decision-making

- Enhanced customer service

Let us understand each outcome.

With the help of AI in the insurance industry, you can analyze applications, verify crucial information, and assess risk profiles in real time. This way, it is possible to eliminate manual data entry. In addition, AI can handle basic claims by gathering and verifying information. So, you can focus on complex claims and reduce processing time significantly.

AI in insurance can analyze a wider range of data points, including telematics health data, to create a potentially accurate picture of an individual’s risk. This can improve decision-making and allow for fairer and more competitive premiums.

Finally, AI can analyze customer data to predict needs and recommend tailored insurance products. This personalized approach can boost customer retention and satisfaction. Overall, such benefits contribute to profoundly improving efficiency.

2. Reduction in Costs

Another positive impact of AI in insurance is decreasing different cost types. Consider the following points:

- Through automation, AI can enable human employees to focus on complex cases and higher-value activities, reducing overall labor costs

- By handling routine tasks like issuing policies, AI can reduce processing times and the associated costs for insurers

- Artificial intelligence helps minimize errors that can occur through manual data entry and processing. Resultantly, you can avoid costly rework and delays

Notably, reputed insurers experience a reduction in underwriting time and claims processing costs after adopting AI. You can thus choose top AI software development services to save such expenses.

Want to reduce costs by integrating custom AI tools? Contact us to start a new AI-based custom project.

3. Detection of Frauds

Insurance fraud is a genuine concern in the modern era. In fact, every year, these frauds cost consumers a whopping USD 308.6 billion!

The use of AI in insurance can help counter this challenge. How? The following table presents some practical use cases

| Utility of AI | Explanation |

| Pattern Recognition | AI can analyze historical fraud data, including claim history, policyholder information, and even weather patterns to identify red flags associated with fraudulent claims |

| Text Analysis | Artificial intelligence can identify a claim form for suspicious language or inconsistencies |

| Network Analysis | AI can analyze relationships between policyholders, repair shops, and medical providers. This way, you can catch a network of individuals involved in a potential fraud |

| Anomaly Detection | AI can analyze incoming claims data and compare it to historical patterns. Such tools can also flag deviations from normal patterns |

| Predictive Analytics | Through effective analysis of historical data, AI in insurance can predict the possibility of fraudulent claims |

Notably, using AI tools is quite straightforward. However, it’s your expertise and understanding of the industry that makes the difference. You only need to choose a skilled development team to build an ergonomic solution for your business, and your role in leveraging AI to detect and prevent fraud becomes even more crucial.

4. Improvement in Customer Experience

The insurance industry depends heavily on customer satisfaction. So, using AI in insurance can help you generate leads or retain existing clients profoundly.

Here are some positive impacts of AI’s utility:

- Tailored Experience: AI can analyze customer data and browsing habits to recommend the most suitable insurance products. Also, this technology has the potential to suggest personalized pricing options depending on your risk profile

- Streamlined Processes: AI virtual assistants can answer frequently asked questions, process simple requests, and provide basic policy information

- Fast Processing: By automating several tasks AI reduces processing times and frustration for customers

- Accessible Risk Management Tools: You can also use AI to develop tools that help customers manage risk and potentially lower premiums. For example, AI-powered apps can track driving habits and provide feedback to help customers become safer drivers

All these utilities showcase the promising impact of AI in the insurance industry. So, even you can refine your customer’s experience by adopting such smart technologies.

5. Creation of Accurate Risk Profiles

AI in insurance leverages data to identify patterns you might miss due to traditional tactics. Be it external records like public information, social media activity, and weather patterns, AI creates a solid database.

In addition, this technology can detect connections between seemingly unrelated data points that might indicate a higher risk profile. You can also use AI to analyze past claims data and predict the likelihood of future claims.

Such information leads to the following benefits:

- Fair pricing

- More customized coverage

- Improvement in risk management

So, companies or insurers can create accurate risk profiles using artificial intelligence.

Which AI services can you leverage to boost your insurance brand?

Challenges of Using AI in Insurance

The use of AI in the insurance industry indeed has several positives. Still, with every technology, you need to counter the downsides. In this section, you can comprehend some practical challenges experts associate with using artificial intelligence.

Potential Job Displacements

Here are some tasks that AI can replace:

- Data entry

- Document processing

- Initial claim assessment

- Simple claim processing

Through automation, it is possible to streamline repetitive tasks that require basic skills. So, job profiles of administrative staff can become prone to replacement.

So, is there a solution?

Yes. Insurance companies like yours can invest in retraining programs to equip employees with pertinent skills. Furthermore, human expertise will remain crucial for complex claims handling, customer service, risk analysis, and strategic decision-making. So, such jobs can still sustain in the modern age.

Algorithmic Biases

AI in insurance is prone to algorithmic bias. Why?

Well, artificial intelligence depends on historical data. If this data contains inherent biases, the output will be the same.

In fact, even seemingly objective data points can contain underlying biases. For example, analyzing car accident data might show a correlation between young drivers and accidents. So, the artificial intelligence model can provide a prediction or create a risk profile based on such interconnections.

So, are there some tactics to mitigate this challenge?

Well, you need to carefully scrutinize the data sets to identify and address potential biases before training AI models.

Also, rigorous testing is vital to ensure that AI in insurance produces fair and unbiased results across different demographic groups. Techniques like fairness metrics can help identify bias. While AI automates tasks, human oversight will always remain supreme. Insurance professionals like you can review AI-generated recommendations for potential bias and ensure fair treatment for all customers.

Privacy Concerns

One of the biggest apprehensions about using AI in the insurance industry is safeguarding user privacy. Artificial intelligence utilizes data. Nowadays, AI extracts relevant information from connected devices, social media, and even public records.

Also, insurers might share customer data with third-party vendors involved in AI development to obtain a more detailed picture. Such aspects lead to privacy concerns when using AI in insurance.

So, are there ways to overcome this concern?

Well, for starters, you need to be transparent about data collection, usage, and sharing details. Implementing robust cyber security measures is also essential. It also helps to collect only the data necessary for legitimate insurance purposes.

Finally, customers should have the right to access their data and understand how AI uses it.

AI in Insurance: The Scope and Future

As you can notice, AI is becoming integral to many sectors. Similarly, the finance domain is another crucial inclusion. AI in insurance has the following trending scope:

- Fraud detection

- Claims processing

- Risk management

- Underwriting

- Customer service

- Personalized pricing

We already explained all these pointers in the ‘impact’ section. The future of AI in insurance is an extension of these facets.

You can utilize this revolutionary technology for the following possible applications:

- Claims Management: Advanced chatbots with natural language processing (NLP) capabilities could handle complex claims conversations, understand customer intent, and potentially resolve claims entirely through AI interaction

- Usage-Based Insurance (UBI): Telematics data can provide a more in-depth picture of risk, allowing for the development of UBI models

- Hyper-personalization: AI can enable highly customized insurance products that suit an individual’s evolving needs and risk profile

- Advanced Risk Mitigation: AI in insurance might also predict potential risks based on sensor data, allowing for preventative measures and reducing future claims

All in all, the utility of AI in the insurance industry appears promising. So, it is crucial that you elevate your knowledge and integrate this technology in your existing workflow.

To Wrap Up

AI in insurance is the use of artificial intelligence to enhance the customer experience and boost insurers’ productivity. In the insurance industry, AI can work through automation, virtual assistance, machine learning, and data analytics.

Using AI in the insurance industry has several positive effects. This technology can improve efficiency, reduce costs, detect fraud, refine customer experience, and create accurate risk profiles.

However, with all these benefits, you need to overcome specific challenges. For instance, AI can lead to potential job displacements and is prone to algorithmic biases. There are also some privacy concerns associated with the application of AI. It is possible to counter all these apprehensions through systematic mitigating actions.

AI can revolutionize the insurance industry with futuristic applications like claims management, UBI, and advanced risk mitigation. So, ensure you capitalize on this technology and develop your custom AI software. If you need help building such a tailored platform or tool, contact our AI developers, and we will create an ergonomic tool for your insurance business.

Frequently Asked Questions

1. How to use generative AI in insurance?

You can use generative AI to create personalized policies, create realistic simulations of potential risks, and build customized marketing materials. Remember, it can be beneficial to understand the difference between generative and predictive AI before planning such activities.

2. How can artificial intelligence help in insurance claims?

AI can improve processing speed, detect fraud, and automate tasks. These advantages can boost the claims process, thereby enhancing customer satisfaction.

3. Can AI in insurance replace human agents?

Artificial intelligence cannot entirely replace human agents. However, it can change the role of these professionals by handling repetitive tasks and providing insights for making informed decisions.